Turn2us is the operating name of Elizabeth Finn Care. Main elements of approaching crisis include tax increases due to expiration of Bush tax cuts and other tax measures that Congress has allowed to slip, along with budget cuts due to super committee flop. Registered office: Hythe House, 200 Shepherds Bush Road, London W6 7NL. Federal Reserve Chairman Ben Bernanke warns lawmakers of “massive fiscal cliff” at year-end. Deep, mandatory budget cuts triggered for 2013.

Republicans, Democrats settle dispute by forming “super committee” to examine fiscal reform. debt ceiling becomes focus of fight in Congress. Treasury Department request for increase in U.S. according to the Congressional Budget Office. Obama agrees to extend Bush tax cuts for two years. The expiration at of the so-called Bush tax cuts at the end of 2010 raises questions about what is best for pulling the country out of the. Led by Tea Party conservatives, Republicans win control of House of Representatives in mid-term elections. The most important of the permanent provisions are the law’s corporate tax cuts. 1 would increase on-budget deficits by about 1,456 billion over the period from 2018 to 2027. Excluding the estimated 19 billion increase in off-budget revenues over the next 10 years, JCT estimates that H.R. Instead of extending all the temporary parts of the Trump tax law as Republicans propose, Congress should move in the opposite direction and scale back the permanent parts of the 2017 law. A portion of the changes in revenues would be from Social Security payroll taxes, which are off-budget.

#Congressional budget office bush tax cuts plus

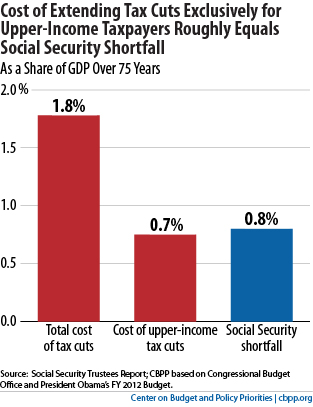

Its plan for drastic fiscal reform is largely ignored. In August 2010, the Congressional Budget Office (CBO) estimated that extending the tax cuts for the 20112020 time period would add 3.3 trillion to the national debt, comprising 2.65 trillion in foregone tax revenue plus another 0.66 trillion for interest and debt service costs. Partially Reverse Trump’s Corporate Tax Giveaways: 1.3 trillion. Obama creates Simpson-Bowles deficit reduction panel. Obama signs healthcare overhaul into law. Even the non-partisan Congressional Budget Office released a report that included estimates that suggest that tax cuts disproportionately benefited. President Barack Obama, Congress enact $787 billion stimulus, including expanded “temporary” tax breaks for children, education.

0 kommentar(er)

0 kommentar(er)